Deficits, Debt and Markets: Myths vs. Realities

U.S. federal government deficits and debt levels have risen steeply since the pandemic, raising concerns about the impact on the economy and financial markets. We share those concerns. As a reminder, the "deficit" refers to the budget deficit, which is the annual mismatch between what the U.S. government takes in and what it spends. Government "debt" is the cumulative effect of running budget deficits. High and rising deficits mean more of the federal budget goes to financing costs, potentially crowding out other spending. Without some constraint, the rate of increase could become unsustainable over time.

However, we want to bring some perspective to the topic. Historically, the level of debt has had no correlation with the performance of the stock or bond markets in the United States. Moreover, the evidence suggests that although the supply of U.S. Treasury securities is increasing, the demand appears to be strong enough to prevent a spike in interest rates. We don't anticipate that will change in the foreseeable future. Most importantly, we don't believe investors should change their long-term investment plans based on the potential for a debt crisis.

Size and scope of the issue

Through the first seven months of fiscal year 2024 (each government fiscal year begins in October), the cumulative deficit hit $855 billion, which is slightly less than the $925 billion deficit for the first seven months of fiscal year 2023. For the 12 months ending in April 2024, the deficit was $1.6 trillion, which is 5.8% of gross domestic product (GDP). Areas of increased spending so far in this fiscal year are shown below, with the largest increase in net interest expense and the largest decrease in education.

Spending through the first seven months of the fiscal year

Source: Department of the Treasury, as of April 2024.

Areas of revenue change so far in this fiscal year are shown below, with the largest increase in corporate tax revenues and the largest decrease in estate tax revenues.

Federal revenues by source

Source: Department of the Treasury, as of April 2024.

The continued running of deficits each year has boosted U.S. federal government debt to more than $34 trillion, or about 120% of U.S. GDP, as shown in the first chart below. That's the equivalent of more than $100,000 for every person in the United States. Over the next 10 years, the loftiest growth rates for spending are expected to be for Social Security and health care, as well as net interest payments, as shown in the second chart below.

Total debt has risen to about 120% of U.S. GDP

Source: Charles Schwab, Bloomberg, as of 12/31/2023.

Projected growth in U.S. government spending

Source: Charles Schwab, CBO (Congressional Budget Office): The Budget and Economic Outlook: 2024 to 2034 (as of 2/7/2024).

Forecasts contained herein are for illustrative purposes only, may be based upon proprietary research and are developed through analysis of historical public data.

As of first quarter 2024, government spending as a percentage of GDP was about 23%—elevated relative to history, but also well down from the pandemic peak of more than 40%, as shown below.

Government spending as a percentage of GDP

Source: Charles Schwab, Bloomberg, Federal Reserve, Ned Davis Research, as of 3/31/2024.

©Copyright 2024 Ned Davis Research, Inc., Further distribution prohibited without prior permission. All Rights Reserved. See NDR Disclaimer at www.ndr.com/copyright.html. For data vendor disclaimers refer to www.ndr.com/vendorinfo/. Yellow dotted lines represent "above 21.4%" and "below 17.9%" government spending as a percentage of nominal GDP, which is further explained in the table below.

Historically, high government spending has generally corresponded with lower economic growth. As shown below, across the spectrum of real GDP, payrolls and business capital spending, growth rates have been weaker when government spending was rising and/or high. Also notice that the highest zone of government spending does not correspond to the highest zone of inflation historically.

Economic data growth rates have been lower when government spending was higher

Source: Charles Schwab, Bloomberg, Federal Reserve, Ned Davis Research, Inc., as of 3/31/2024.

©Copyright 2024 Ned Davis Research, Inc. Further distribution prohibited without prior permission. All Rights Reserved. See NDR Disclaimer at www.ndr.com/copyright.html. For data vendor disclaimers refer to www.ndr.com/vendorinfo/. CPI represents the Consumer Price Index, a measure of inflation.

Of course, it's not just the level of debt that matters, but the interest payments due on that debt. Per Congressional Budget Office (CBO) estimates, interest payments are expected to continue to rise as a share of GDP, from 2.5% as of the end of 2023 to nearly 4% in 10 years.

Net interest payments as a percentage of GDP

Source: Charles Schwab, CBO (Congressional Budget Office): The Budget and Economic Outlook: 2024 to 2034 (as of 2/7/2024).

Forecasts contained herein are for illustrative purposes only, may be based upon proprietary research and are developed through analysis of historical public data.

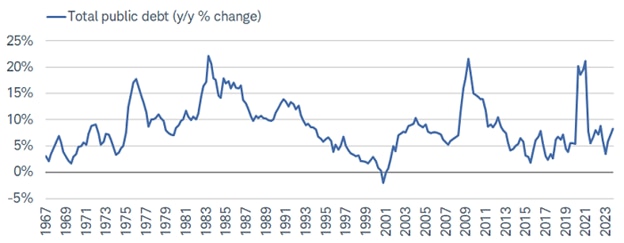

Ideally, the growth rate of debt is lower than the growth rate of the overall economy. Thanks to the removal of much of the pandemic-related direct fiscal stimulus, and the beneficial impact on tax receipts courtesy of the strong economic recovery coming out of the lockdowns, both worked in favor of bringing down the rate of debt growth. But since the plunge from more than 20% during the early part of the pandemic to only about 3% last year, the growth rate of debt has accelerated again to more than 8%—obviously well north of GDP growth.

Changes in total public debt

Source: Charles Schwab, Bloomberg, as of 12/31/2023.

Washington perspective

The debate over deficits and debt is a never-ending one in the nation's capital and Washington is poised for another titanic battle next year. That's because the debt ceiling returns in 2025. The debt ceiling is the congressionally mandated cap on the total amount of debt the United States can accumulate. In June 2023, Congress suspended the debt ceiling until January 1, 2025, after a months-long debate that brought the country to the precipice of default.

When the debt ceiling returns, the United States will be unable to accumulate more debt until Congress raises it. The Treasury Department, however, can buy Congress more time by taking a series of steps known as "extraordinary measures" to ensure the United States does not default. Those steps are finite and typically last a few months. That puts the true deadline for Congress to act somewhere in the spring of 2025. Of course, debt ceiling debates are not about reducing the debt or the deficit. They are about permitting the United States to accumulate more debt.

Another key element of the 2025 debate will be taxes, as all of the 2017 tax cuts—including the lower individual income tax rates, the higher standard deduction, the increased assets that can be inherited without triggering the estate tax and many more—are set to expire at the end of 2025. The CBO has offered a preliminary estimate that simply extending all of those tax cuts will cost the U.S. Treasury $4.6 trillion in lost revenue over the next decade; substantially increasing both the deficit and debt. Debate over what to do about the expiring tax provisions will feature a difficult series of choices around offsetting any extensions of lower taxes with increased taxes or dramatic spending cuts elsewhere.

The debate in Washington over reducing federal spending is an annual one, as each year Congress must pass the 12 appropriations bills that fund every agency and government program. But much of the annual budget of the federal government is mandated by law. In 2023, 61% of the federal budget was for Social Security, Medicare, Medicaid, veterans' programs, federal retirement programs and more. Moreover, net interest on the debt is now the fastest-growing part of the federal budget, due to higher interest rates. Last year, as noted above, net interest expense is growing rapidly and represented about 11% of all federal spending in fiscal year 2023. In fiscal year 2024, net interest will be the second largest expenditure of the federal government, behind only Social Security.

As a result, discretionary spending—the portion of the federal budget that is determined each year by Congress—currently represents just 28% of the budget. About half of that goes to defense. There just isn't enough left to cut in order to balance the budget.

When members of Congress are arguing over cutting a few billion from this agency's budget or that federal program, it represents a drop in the bucket compared to a $1.7 trillion deficit in the 2023 fiscal year. The currently divided Congress is not likely to make any dramatic changes to the federal budget in an election year, leaving 2025 as a potential year to watch in the debate over trying to get the deficit under control.

Impact on the bond market

The big concern among bond investors is that rising deficits will lead to higher interest rates. To fund the deficit, the U.S. Treasury will need to continue increasing issuance of Treasury securities, adding to the already large stockpile of bonds on the market. With the Federal Reserve keeping interest rates high, the cost of financing the debt grows as well.

Investors fear that the rising tide of supply will overwhelm investor capacity, and/or that lack confidence in the country's debt management will lead investors to demand higher interest rates. We're sympathetic to these concerns. However, the evidence suggests that the bond market is capable of handling the rise in government debt. Here are three reasons that counter some of the worst fears.

1. Demand for U.S. Treasuries is strong. While much of the concern has been focused on the increasing supply of Treasuries, the demand side is often ignored. Regarding demand, the outlook remains favorable, in our view. U.S. Treasuries are still sought after by domestic and foreign investors for transactions, savings, liquidity, and yield.

Looking at the bidding in the quarterly Treasury auctions over the past few years, there hasn't been a discernible change despite the increased sizes. As shown below, the average bid/cover ratio—a measure of the strength of bidding—has averaged about 2.5 times for 10-year Treasuries since 2018. In fact, the ratio is less volatile now than it was in the 1990s.

Treasury demand has been generally steady

Source: Bloomberg.

UST 10-year Note Bid-to-Cover Ratio (USN10YBC Index), US Generic Govt 10 Yr (USGG10YR Index). Data as of 4/30/2024. Past performance is no guarantee of future results.

One reason for strong demand is that individual and institutional investors are not highly leveraged in this cycle. During the pandemic, government debt levels rose but private sector savings grew. Consequently, there hasn't been "crowding out" because households and companies don't necessarily have to borrow heavily. In fact, many are using the high interest rates offered on Treasuries to increase income and savings. Notably and as highlighted below, households and money market funds have more than doubled their holdings of Treasuries over the past five years as interest rates have moved up.

Treasury holdings

Source: Bloomberg, Federal Reserve. Data as of 12/31/2023.

In addition, as shown below, foreign private investment in Treasuries has risen sharply. Foreign reserve holdings haven't kept up with increased issuance, but private foreign investment flows have closed the gap, as the yield on U.S. Treasuries is about 250 basis points (or 2.5 percentage points) higher than the yields on other major developed market bonds. Institutional investors like banks, insurance companies and pension funds, use Treasuries to meet regulatory requirements or reduce risk in their portfolios. Domestic money market funds and households are more yield- or price-sensitive. Notably, they have more than doubled their holdings.

Foreign Treasury holdings

Source: Bloomberg and the Schwab Center for Financial Research, using monthly data as of 3/31/2024.

Foreign Official Treasury Bill holdings represented by US Treasury Securities Foreign Holders Foreign Official Bills (HOLDBILL Index), while Foreign Private Treasury Bill Holdings are imputed using US Treasury Securities Foreign Holders Foreign Official Bills (HOLDBILL Index) and US Short Term Treasury Obligations Total (BILLTOTL Index).

2. Treasuries benefit from the role of U.S. dollar as world's reserve currency. The U.S. dollar's role as the world's reserve currency also creates demand for Treasuries. The dollar is used in more than 75% of all global transactions and accounts for about 60% of reserves at foreign central banks, as shown below.

About 60% of global reserves are in U.S. dollars

Source: Bloomberg. Quarterly data as of 3/30/2024.

Foreign Exchange Holdings as a Percentage of Total Allocated in U.S. Dollars, the Euro, the Yen, the Renminbi, and Other Reserve Currencies which are the Swiss Franc, Canadian Dollar, Australian Dollar, Great British Pound, and unclassified others (CCFRUSD% Index, CCFREUR% Index, CCFRJPY% Index, CCFRCNYP Index, CCFROTR% Index, CCFRCHF% Index, CCFRCADP Index, CCFRAUDP Index, CCFRGBP% Index).

Countries with large trade surpluses, such as Japan and China, accumulate dollars through trade and typically invest those dollars in U.S. Treasuries. Much has been made of China's central bank reducing its U.S. Treasury holdings, but the details of those shifts are not clear given that China holds reserves in other countries that don't show up in the official data. In any case, the U.S. dollar has been in a long-term bull market for over a decade, as shown below. If foreign investors were shunning U.S. Treasuries, the dollar would likely be declining.

The dollar has remained relatively strong

Source: Bloomberg. Bloomberg Dollar Spot Index (BBDXY Index). Daily data as of 5/20/2024.

Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance is no guarantee of future results.

There are few alternatives to the dollar and Treasuries for large global investors. The U.S. Treasury market is the largest and most liquid government bond market in the world, which allows institutional investors to access large quantities of funds easily. In comparison, most other markets are smaller and provide less liquidity. For example, while the eurozone is large in terms of GDP, it is comprised of 17 distinct bond markets with somewhat different characteristics, which makes it less liquid.

Moreover, the United States recently reinforced its leading role in the global financial markets. During the pandemic, the U.S. Federal Reserve backstopped global dollar funding markets, helping the many offshore entities that borrow in dollars. These emergency lines helped stabilize markets and economies. If anything, reliance on the United States for global liquidity appears to have grown over recent years.

3. There is no historical correlation between debt and interest rates. Historically, there hasn't been a correlation between rising U.S. deficits or debt levels and interest rates, as shown below. It is counterintuitive, but Treasury yields have not been driven by this factor. Instead, the major factors driving U.S. interest rates are Federal Reserve policy, inflation, and economic growth. Treasury issuance doesn't register as a significant driver of yields.

Treasury yields and budgets

Source: Bloomberg.

US Treasury Federal Budget Deficit or Surplus as a % of Nominal GDP (FDDSGDP Index), US Generic Govt 10 Yr (USGG10YR Index). Data is from 1/30/1970 through 4/30/2024.

R2 represents the proportion of the variation in the dependent variable that is predictable from the independent variable(s). Correlation is a statistical measure of how two investments have historically moved in relation to each other, and ranges from -1 to +1. A correlation of 1 indicates a perfect positive correlation, while a correlation of -1 indicates a perfect negative correlation. A correlation of zero means the assets are not correlated. The yellow dotted line is a "regression line," which shows the trend in the data given in the scatterplot.

There is also essentially no correlation between the budget deficit (or surplus) and inflation; shown below using the Federal Reserve's preferred inflation metric, the personal consumption expenditure index excluding food and energy prices, or core PCE.

Inflation and budgets

Source: Charles Schwab, Bloomberg. Data is from 1/30/1970 through 4/30/2024.

R2 represents the proportion of the variation in the dependent variable that is predictable from the independent variable(s). The yellow dotted line is a "regression line," which shows the trend in the data given in the scatterplot.

Potential impact on the stock market

The bond market is likely to remain a key driver of equities; specifically the elevated inverse relationship between changes in the 10-year Treasury yield and equities, as shown below. The most significant risk to the stock market—related to government debt concerns—would be a significant increase in yields over a relatively short period of time (particularly if not accompanied by stronger economic growth).

Inverse relationship between stocks and bond yields

Source: Charles Schwab, Bloomberg, as of 5/28/2024.

Ten-year bond yield represented by 10-year bond yield index (USGG10YR Index). Indexes are unmanaged, do not incur management fees, costs, and expenses and cannot be invested in directly. For more information on indexes

Correlation is a statistical measure of how two investments have historically moved in relation to each other, and ranges from -1 to +1. A correlation of 1 indicates a perfect positive correlation, while a correlation of -1 indicates a perfect negative correlation. A correlation of zero means the assets are not correlated. Past performance is no guarantee of future results.

Conclusion

We share investors' concerns about the rising level of debt and deficits in the United States. It would be great to see Congress tackle budget issues now, when the economy is growing, to prevent a further accumulation of debt relative to the size of the economy. However, we don't believe that it makes sense for investors to alter long-term financial plan based on this issue. The lack of correlation between U.S. debt and deficits and interest rates over time makes it difficult to estimate the impact it might have on the economy or financial markets—if any.