Schwab Market Update

Chips Bounce on TSM but Other Earnings, Data Mixed

Published as of: April 17, 2025, 9:15 a.m. ET

Listen to this article

Listen here or subscribe for free to the Schwab Market Update in your favorite podcast app.

| The markets | Last price | Change | % change |

|---|---|---|---|

| S&P 500® index |

5,275.70 |

-120.93 |

-2.24% |

| Dow Jones Industrial Average® |

39,669.39 |

-699.57 |

-1.73% |

| Nasdaq Composite® |

16,307.16 |

-516.01 |

-3.07% |

| 10-year Treasury yield |

4.29% |

+0.01 |

-- |

| U.S. Dollar Index |

99.64 |

+0.26 |

+0.26% |

| Cboe Volatility Index® |

30.97 |

-1.67 |

-5.20% |

| WTI Crude Oil |

$63.59 |

+1.12 |

+1.79% |

| Bitcoin |

$84,753.99 |

+$599.83 |

+0.71% |

(Note to readers: U.S. markets are closed Friday, April 18, in observance of Good Friday. The Schwab Market Update will return on Monday, April 21.)

(Thursday market open) U.S. indexes diverged as a rebound in downtrodden chip stocks lifted one part of the market while weak earnings from UnitedHealth (UNH) weighed on another. Even with chip shares up, anxiety stalks tech after Nvidia's (NVDA) sharp losses due to trade policy and signs of falling demand from semiconductor equipment firm ASML (ASML). Today's booming earnings from Taiwan Semiconductor Manufacturing (TSM)—which said demand remains robust—only soothed worries slightly.

"The restrictions on Nvidia's H20 chip exports to China and ASML's missed orders have added to investor anxiety, sparking concerns over a potential slowdown in AI demand and the semiconductor sector," said Jeffrey Kleintop, chief global investment strategist at Schwab. "The developments have also raised concerns over the impact of tariffs on global companies, with economists scaling back their forecasts for GDP growth worldwide and the semiconductor sector being highly sensitive to economic cycles."

UnitedHealth fell nearly 20% this morning, hurting the Dow Jones Industrial Average ($DJI) even as chips supported the Nasdaq Composite ($COMP) in pre-market trading. Later today investors get earnings results from streaming giant Netflix (NFLX), and this morning's data included initial weekly jobless claims, which remained relatively low at 215,000, and housing starts and building permits. Investors also have their eye on developments in the trade war as President Trump posted of progress in talks with Japan and plans a meeting with Italy's prime minister.

To get the Schwab Market Update in your inbox every morning, subscribe on Schwab.com.

Three things to watch

1. Security check: Recent sour outlooks from some of the major U.S. airlines haven't shown up so far in daily Transportation Security Administration (TSA) checkpoint travel numbers, but that could be a good early indicator if things start to slow down for the air industry. In the seven-day period ended April 15, 17.45 million passengers cleared TSA checkpoints, the agency said. That was up a whisker from 17.28 million for the same seven days a year earlier, hinting that travelers aren't canceling flights just yet. The question is how this plays out over coming months as travel demand from foreign countries appears to be slowing in reaction to anger over trade policy and U.S. businesses brace for possible rising costs. Boeing (BA), American Airlines (AAL), and Southwest (LUV) are among the industry names reporting next week. Boeing took a blow earlier this week when China ordered its airlines to stop buying U.S. jets.

2. New puzzles for tech: Yesterday's bad news for semiconductor stocks as the Trump administration threw new export blockades at the industry highlights why some investors have shied away. The trade restrictions—which may keep certain chips from Nvidia (NVDA) and Advanced Micro Devices (AMD) out of China for security reasons—came after Nvidia already suffered several downgrades and price target reductions from Wall Street in recent weeks. It's rare for analysts to downgrade mega-cap tech, but Meta Platforms (META) received a price target cut from DA Davidson this week, too. U.S. and China seem far from any major deal, which means it's hard for analysts to model future earnings and revenue growth. The export restrictions announced yesterday didn't ban the chip exports but simply required licenses, those licenses could take months or years to obtain, analysts said. By then, the chips might be obsolete, and Chinese chip firms may offer the technology. That scenario would likely close off one path for U.S. chip firms to market their wares to China for the foreseeable future. China accounts for about 13% of Nvidia's sales, down from 26% a few years ago.

3. Mixed data: This morning's big data dump had something for the bulls and bears. As noted, initial jobless claims stayed low, a possible hint that trade uncertainty hasn't yet bled into the labor market. But on the same day that home builder D.R. Horton (DHI) cut guidance and cited weak demand, March housing starts of 1.324 million on a seasonally adjusted annual basis fell far short of expectations—by almost 100,000 and down 11.4% from a month earlier. It was the lowest reading in four months. While building permits stayed solid, another economic indicator, the Philadelphia Fed Index, which measures manufacturing activity in the mid-Atlantic region, cratered to –26.4 in April, down from 12.5 in March and well below the Briefing.com consensus of 10. Anything below zero indicates contraction, and this was the weakest reading in two years. This occurred even as prices paid rose, adding another "stagflationary" indicator to the basket. There's no data tomorrow with markets closed for the holiday, but next week brings March leading indicators from the Conference Board, new home sales, and final April consumer sentiment.

On the move

- United Healthcare fell 19% in pre-market trading after the health insurer missed analysts' first-quarter earnings estimates and cut guidance. The company is under pressure from rising care activity in its Medicare Advantage business and from Medicare funding reductions.

- Taiwan Semiconductor Manufacturing rose 3.4% in pre-market trading after surpassing Wall Street's first quarter earnings expectations and keeping previous revenue guidance, a boost to sector confidence after recent trade-related anxiety. First quarter revenue rose 41.6% from a year earlier on solid sales of its AI chips, and the company said it hasn't "seen any changes in our customers' behavior so far" despite uncertainties and risks from tariff policy. TSM is the largest semiconductor foundry in the world.

- Netflix climbed 1.4% ahead of the open as the company plans to report earnings later today. The company no longer reports quarterly subscriber count gains, taking some starch out of today's report. Instead, investors may watch for progress in its attempt to bring more advertising to its lower-tier ad-supported service. The stock is one of just 74 in the SPX trading above its 50-day moving average, MarketWatch noted.

- Nvidia, Broadcom (AVGO), and Advanced Micro Devices—all hit hard by yesterday's chip sell off—made slight gains in early trading Thursday following strong earnings from TSM.

- American Express (AXP) pulled back to just about flat after rising 0.6% earlier in pre-market trading after topping analysts' earnings expectations. Card member spending "continued to be strong across our customer base, consistent with and in many cases better than what we saw in 2024," the company said, as it kept its full-year guidance. AXP is often seen as a barometer for spending by the affluent.

- Alcoa (AA) fell 1.4% ahead of the open after the steel maker missed analysts' revenue expectations and detailed tariff costs on imports of Canadian aluminum.

- Shares of home builder D.R. Horton lost 3.4% after it cut its revenue forecast on weak home demand. "The 2025 spring selling season started slower than expected as potential homebuyers have been more cautious due to continued affordability constraints and declining consumer confidence," the company said in its press release.

- The CME FedWatch Tool shows less than a 14% chance of the Fed cutting rates 25 basis points at its early May meeting. The market prices in 68% odds of at least one rate cut by June, but that's down from about 84% a week ago, in part due to hawkish comments from Fed officials including Fed Chairman Jerome Powell yesterday that contributed to market weakness.

- The European Central Bank (ECB) lowered interest rates by 25 basis points, as analysts had expected. The ECB cited "increased uncertainty" that's likely to reduce business and household confidence and the "adverse and volatile market response to the trade tensions."

- Bitcoin (/BTC) rose about 0.7% and continues to hold up during times of stock stress and weakness in other cryptocurrencies. This helped shares of MicroStrategy (MSTR), which rose 1.5%.

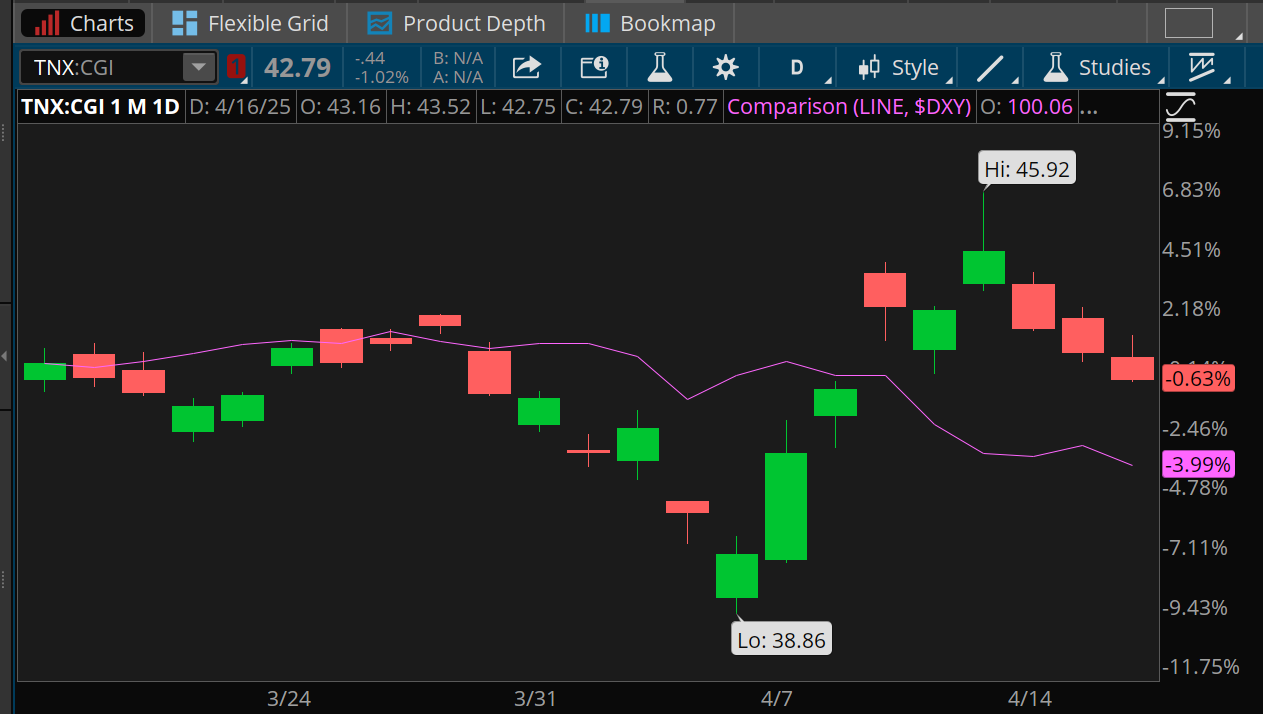

- The closely watched 10-year Treasury note yield (TNX:CGI) was steady early and so was the dollar.

More insights from Schwab

Dividend evaluation: While dividend stocks offer investors income, there are other things to ponder before diving in. This Schwab video discusses how to compare dividend stocks and not be blinded by the yields they offer.

Resources for volatile markets

Turbulent market conditions can make anyone worried about their portfolio, and Schwab offers several perspectives that provide ideas to keep in mind at such times:

Market Volatility: What to Do During Turbulence

Bear Market: Now What?

Market Volatility in Retirement: Are You Prepared?

Navigating the Markets: Tariffs and Trade

Chart of the day

Data sources: Cboe, ICE. Chart source: thinkorswim® platform.

Past performance is no guarantee of future results.

For illustrative purposes only.

This chart might not look too dramatic, but it shows much sharper than normal moves over the last month for both the 10-year Treasury note yield (TNX:CGI—candlesticks) and the U.S. Dollar Index ($DXY—purple line). They're both down for the month, but yields have fallen from last week's spike associated with trade-related concerns about the strength of U.S. assets (Treasuries fall when yields climb). The dollar is at three-year lows, but investors may have felt relief yesterday when Treasuries found some bids, sending yields below 4.3%.

The week ahead

Check out the Investors' Calendar for a summary of the top economic events and earnings reports on tap this week.

April 18: U.S. markets closed for Good Friday holiday, no earnings or data expected.

April 21: March leading indicators.

April 22: Expected earnings from 3M (MMM), Halliburton (HAL), Tesla (TSLA), Kimberly-Clark (KMB), Lockheed Martin (LMT), Northrop Grumman (NOC), and Verizon (VZ).

April 23: March new home sales and expected earnings from Boeing (BA), AT&T (T), Philip Morris (PM), IBM (IBM), and Texas Instruments (TXN).

April 24: March durable goods, March existing home sales, and expected earnings from American Airlines (AAL), PepsiCo (PEP), Merck (MRK), and Intel (INTC).